what is a limited pay whole life policy

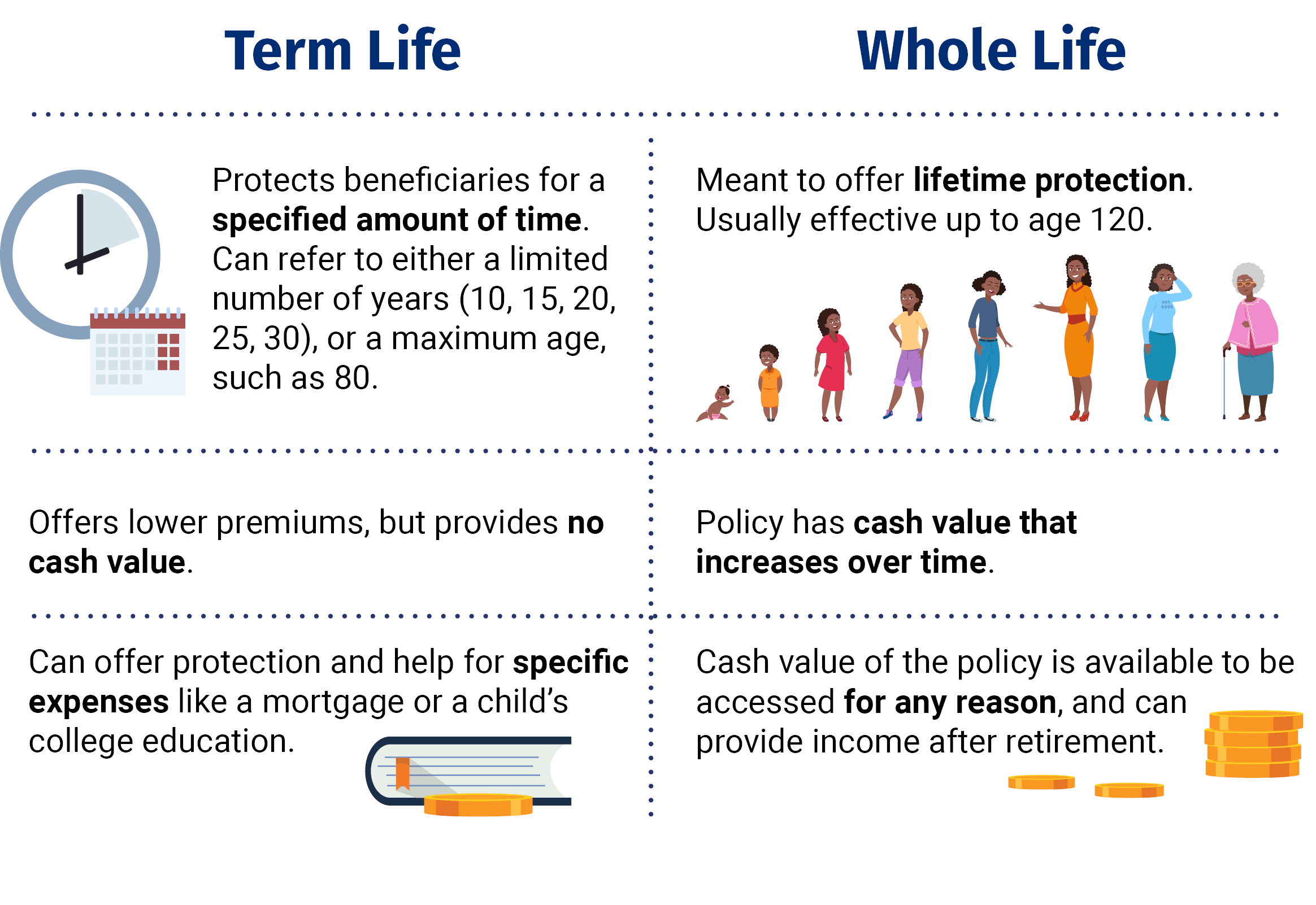

What is the main difference between whole life insurance and limited pay life insurance. Term coverage only protects you for a limited number of years while whole life provides.

Dividend Paying Life Insurance Paradigm Life Blog

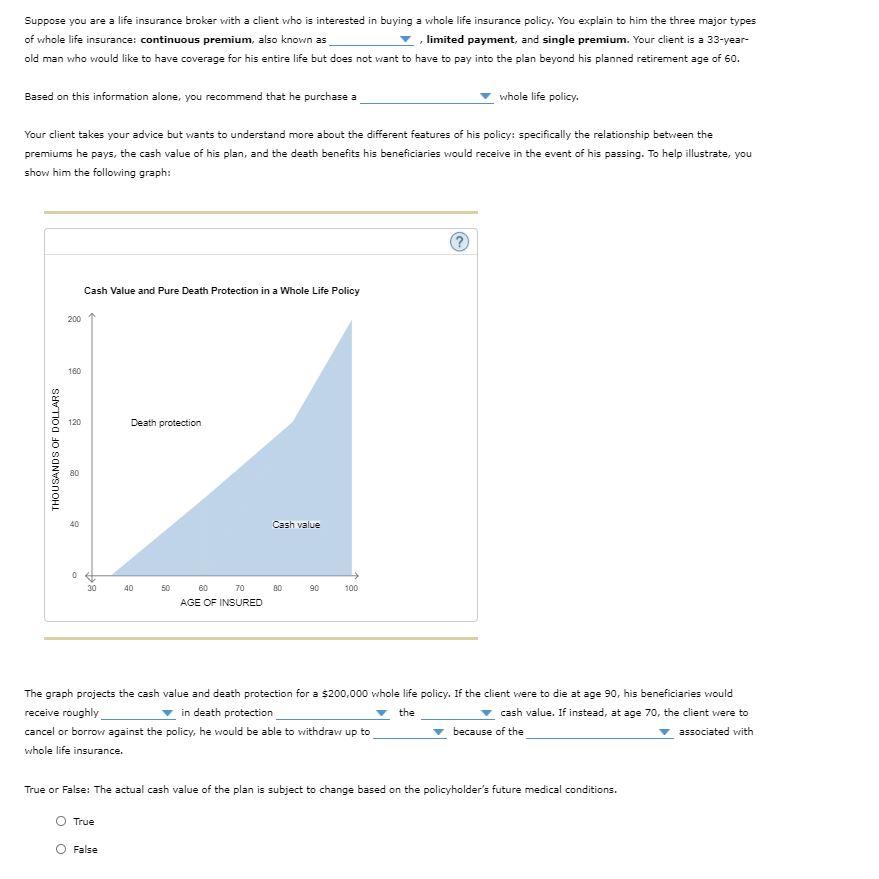

John is a 45-year-old male.

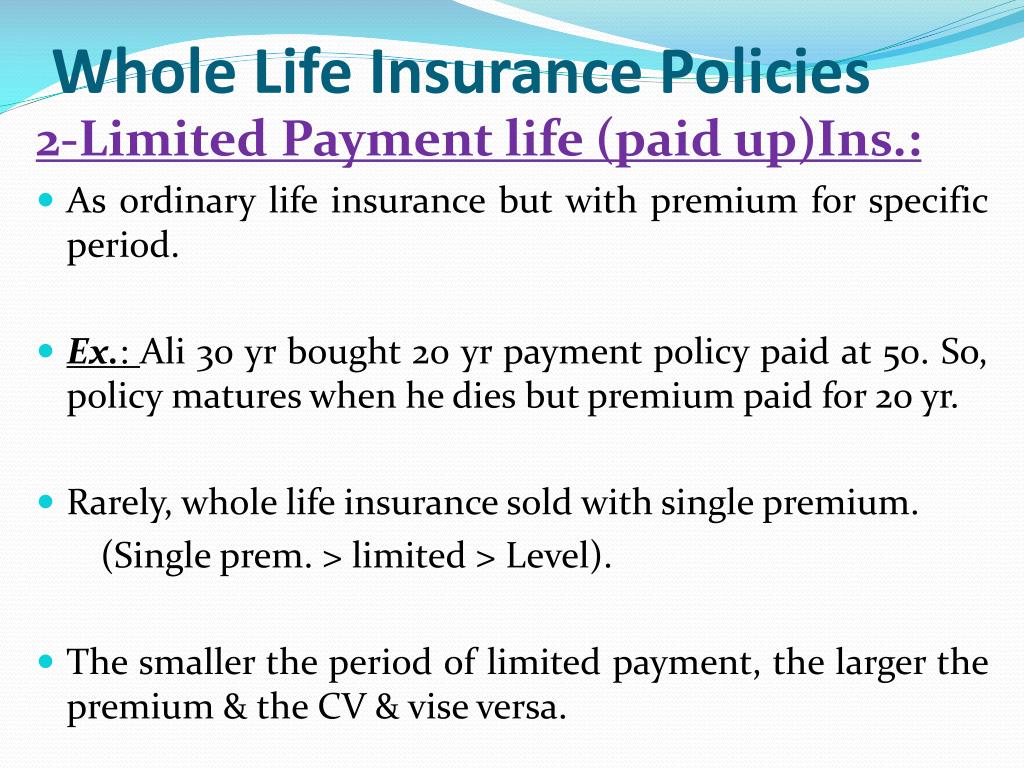

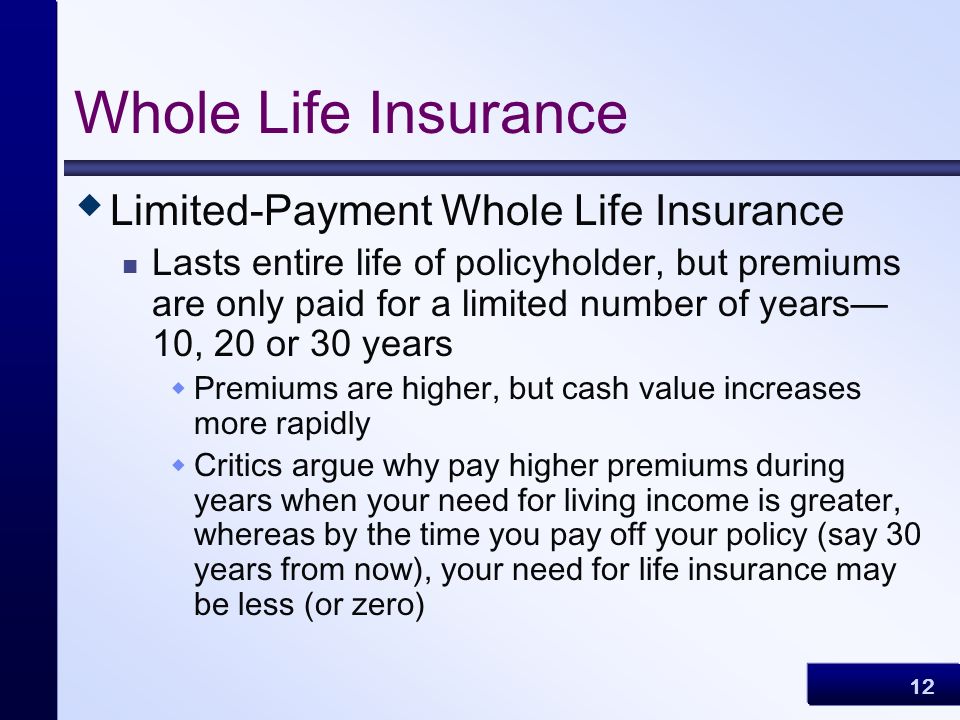

. What is Limited Pay Life Insurance. A limited pay life policy is a type of whole life insurance. Premiums are typically paid over the first 10 to 20 years.

Depending on the terms you make payments. With a 7-pay whole life policy you pay for the policy for 7 years and then its paid up. For a predetermined timeframe.

In other words a graded death. With the limited pay. Limited pay policies work well for people who.

Premiums are usually paid over a period of 10 to 20. Limited pay policies are usually whole life insurance policies that schedule premium payments over a finite period. This policy is a better option for people who want to access their cash value in the future and.

What is a limited-pay life insurance policy. Unlike regular whole life insurance the beneficiary pays premiums over a shorter time instead of their entire lifetime. When selecting the limited pay whole life option the payment length must be selected at the time of policy acquisition.

A limited pay whole life policy is a permanent insurance policy guaranteed to be fully paid-up at a certain date or when you reach a certain age with no. The average life of a limited pay life insurance policy is typically three to four years. If youre close to retirement age and are shopping for affordable life insurance a limited-pay life policy may be the best fit for you.

The main disadvantage of whole life is that youll likely pay higher premiums. Limited pay life insurance is a payment plan with level premiums for a condensed amount of time rather than paying premiums for your whole life. Industry research suggests that average monthly premiums on whole life insurance range from 4068 at age 30 6243 at age 40 to 10628 at age 50 depending on your.

A limited pay life insurance policy allows you to pay your insurance premiums in full within a certain time frame. Traditional permanent life insurance premiums are paid for the whole duration of an. Limited pay life insurance is for an individual who owns a whole life insurance policy but chooses to pay for the total cost of their premiums for a limited number of years.

Common terms are 10 15 or 20 years or up. Updated July 27 2017. Because limited pay policies have fewer premiums to reach paid-up status they need more significant premiums yearly than continuous pay insurance policies.

With a limited pay whole life insurance policy you pay premiums for only a specific amount of time. Graded Benefit Whole Life is defined by when the death benefit will not be paid for the first two to three years unless the death is accidental. When choosing the limited pay whole life option the payment length must be determined at the initial purchase of the policy.

A 10 pay whole life policy is a type of insurance that allows you to. If youre not sure which limited pay whole life insurance structure is right for you or would like to see a financial illustration outlining various premium. A limited pay whole life policy is a type of whole life insurance that only requires premiums to be paid for a certain time can guarantee the premiums will stop and not return.

What Is A 10 Pay Whole Life Policy.

Characteristics Of Life Insurance Policies Youtube

Ppt Chapter 2 Life Insurance Policies Whole Life Insurance Powerpoint Presentation Id 1988231

Comprehensive Guide For Buying A Limited Pay Life Policy

Types Of Limited Pay Life Insurance Top Quote Life Insurance

What Is Limited Pay Life Insurance Paradigm Life Insurance

Whole Life Insurance Insurance Pro Florida

Comprehensive Guide For Buying A Limited Pay Life Policy

Limited Pay Whole Life Series 200 Illinois Mutual

Life Insurance Chapter Ppt Video Online Download

What Is A Limited Pay Life Policy Clearsurance

Limited Pay Product Whole Life Policy Awareness Updated For 7702 Changes Ibc Global Youtube

Suppose You Are A Life Insurance Broker With A Client Chegg Com

Should You Get A Whole Life Insurance Policy We Explain In Details How It Works

Should I Cancel My Whole Life Insurance Policy White Coat Investor

Term Whole Life Senior Financial Group

How Long Does The Coverage Normally Remain On A Limited Pay Life Policy Whole Vs Term Life

Limited Pay Whole Life Insurance Pros And Cons Youtube